Search Results for 'Value added tax'

110 results found.

VAT refunds for charities

It is said that “charity begins at home”. It is also said “look after the pennies and the pounds look after themselves”. Maybe this has been updated for cents and euros I’m not sure but as part of the recent Budget documentation, a report on the VAT cost for charities was released by the Department of Finance. Its main findings and representations were put forward by the Irish charities Tax Reform Group, a working group formed to examine proposals of reducing the VAT burden on charities in Ireland.

Nine per cent VAT rate results in new jobs in Mayo

According to a report published by the Restaurants Association of Ireland, 625 new jobs in the food, tourism, and hospitality sectors have been created in Mayo since the reduced VAT rate of nine per cent was introduced in July 2011.

Upskill with SAGE Line 50 award

In recent times many businesses are relying on debt and credit control to maintain cashflow. A working knowledge of a computerised accounts system such as SAGE will prove beneficial in achieving this task, and will also transfer as an employable skill.

Galway hoteliers welcome further growth in overseas visitors

Galway hoteliers have welcomed the strong growth in visitors to Ireland announced last week The latest figures from the Central Statistics Office show an 11.7% increase in trips to the country by overseas visitors during the first six months of the year.

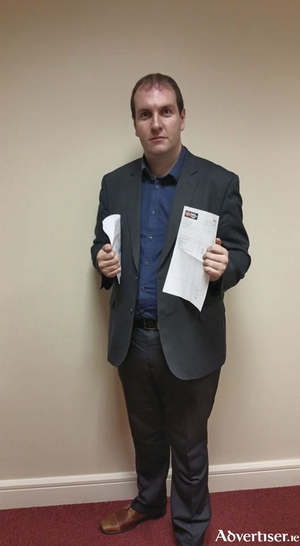

Councillor obtains quote five times cheaper than county council for live online streaming of meetings

A councillor who was informed by the Galway County Council executive that the introduction of technology to facilitate live online steaming of council meetings would cost at least €10,000 plus VAT, has obtained his own quote from a private contractor based in the city and it is substantially lower.

Election 2016 will determine future of water charges

Insider has been thinking lately about what are the limits to democratic expression, are there certain lines that just should not be crossed, and if so what are they?

End of the misery

Sighs of relief could be heard emanating from living rooms, offices and pubs across the country last Wednesday evening as finally after six years of unrelenting misery on Budget days there was some form of relief for hard-pressed citizens. Having endured such negativity in recent years most people would have settled for ‘not being any worse off’ after this Budget but in the end most people probably ended up modestly better off.

Budget 2015 hailed as ‘first in a series of recovery budgets’

By Frances Toner

Chamber wecomes government decision to commence income tax reduction

Galway Chamber has welcomed the Government's decision, as per Budget 2015, to commence income tax reductions but says an opportunity to do more to help SMEs create jobs has been missed.

Budget 2015

Following Ireland’s exit from the EU/IMF recovery programme and in the context of projected GDP growth of 4.7 per cent for 2014 and 3.9 per cent for 2015, Ministers Noonan and Howlin announced their budgetary measures for 2015 which have been set out below. More detail will be included in the Finance Bill to be published later this month.